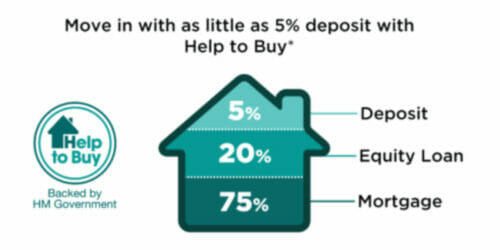

From April 2021, the Help to Buy Equity Loan is available for First Time Buyers only. At Heyford Park, the price cap for properties which can be purchased using the scheme is £437,600.

This scheme offers you a loan from the Government that you put towards the cost of your new home. The minimum loan you can borrow is 5% of the property’s full value and the maximum loan is 20%.

You will only need a 5% deposit of the property’s full value.

For example, if you were buying a property where the full value was £350,000:

Your 5% deposit would be £17,500

The 20% Government loan would be £70,000

Your 75% mortgage would be £262,500

Interest and Paying the Loan Back:

The Equity Loan is interest free for the first 5 years. From year 6 you will start paying a monthly interest fee of 1.75% of the loan amount. The interest rate can rise and you will pay interest until you have repaid the loan in full. (Your interest payments will not go towards repaying the loan).

You must repay the loan in full:

- When you sell your home

- If you come to the end of the equity loan term (usually 25 years)

- When you pay off your mortgage on your home

- If you do not follow the terms set out in the equity loan contract

Frequently Asked Questions about the Help to Buy Equity Loan:

How do I know if I’m eligible for the Help to Buy Equity Loan scheme?

If you are a first time buyer interested in the scheme, we would recommend speaking with a mortgage advisor who can advise you on available mortgages, interest and repayments. They will go through your personal situation and will be able to advise you if the scheme is right for you.

Do I need to have a mortgage on the property to use the scheme?

Yes, you will need to take out a repayment mortgage on at least 25% of the full price of your new home.

What happens if my house increases in value?

The total equity loan value is based on the market value of your home at the time you repay the loan. If the market value of your home increases, so does the amount of the equity loan. If the market value of your home decreases, so does the amount of the equity loan.

When can I start paying off the loan?

You can pay off your equity loan anytime between the day of legal completion and the end of the equity loan term. If you pay off the full loan amount during the first 5 years, there will be no interest to pay. You can either pay back the loan in full or in part payments (your first part payment will need to be at least 10% of your home’s market value).

For more information about the Help to Buy Equity Loan or any other purchaser schemes available, speak to one of our sales consultants. We can also recommend a local mortgage advisor for you to speak with. Why not take a look at the new homes for sale in Oxfordshire, at the Heyford park development.